Bring home pay calculator

See where that hard-earned money goes - Federal Income Tax Social Security and. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

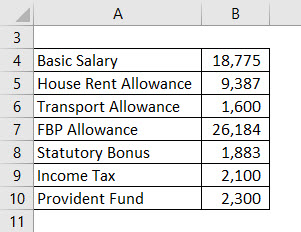

Salary Formula Calculate Salary Calculator Excel Template

The latest budget information from April 2022 is used to.

. How much someone might pay in federal income taxes varies from person to person and depends on factors such as your salary marital status and number of dependents. How much youre actually taxed depends on various factors such as your marital. Financial advisors can also help with investing and financial plans including retirement.

How Your Pennsylvania Paycheck Works. When you make a pre-tax contribution to your. The wage can be annual monthly weekly daily or hourly - just be sure to configure the calculator with the.

UK Take Home Pay Calculator. The state tax year is also 12 months but it differs from state to state. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

We have redesigned this tool to be as easy to use as possible whilst. Use this calculator to find exactly what you take home from any salary you provide. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Some states follow the federal tax. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Your take-home pay is the difference between your gross pay and what you get paid after taxes are taken out. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. The unadjusted results ignore the holidays and paid vacation days. A financial advisor in Virginia can help you understand how taxes fit into your overall financial goals.

To find out your take home pay enter your gross wage into the calculator. Without the help of a paycheck calculator its tricky to figure out what your take-home pay will be after taxes and other monies are withheld. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Related Take Home Pay. Plug in the amount of money youd like to take home. This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations.

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Salary To Hourly Calculator

International Salary Calculator Calculate The Salary You Will Need

Salary Formula Calculate Salary Calculator Excel Template

Net To Gross Calculator

/43535168381_036cd85117_k-80301daf7e594223a5e25fef124e0c13.jpg)

Defining Take Home Pay

How To Calculate Net Pay Step By Step Example

Hourly To Salary Calculator

Hourly To Salary Calculator Convert Your Wages Indeed Com

4 Ways To Calculate Annual Salary Wikihow

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

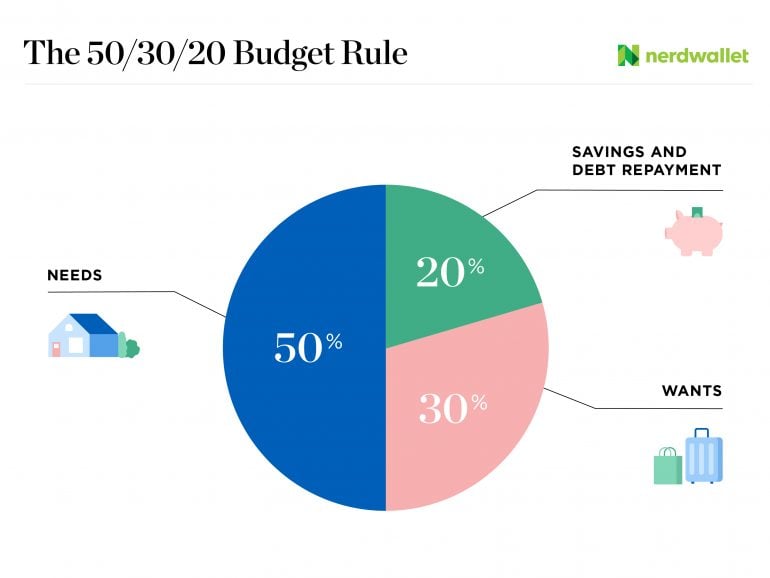

50 30 20 Budget Calculator Nerdwallet

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Salary Formula Calculate Salary Calculator Excel Template

How To Calculate Your Net Salary Using Excel Salary Excel Ads

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math